All Categories

Featured

Table of Contents

[/image][=video]

[/video]

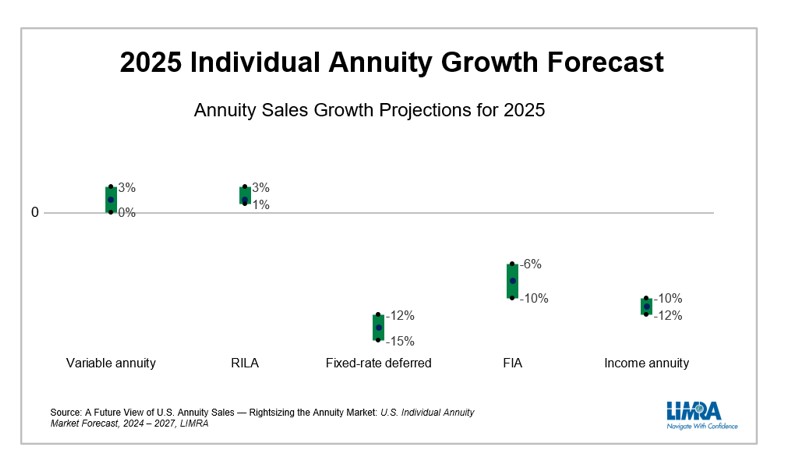

However the landscape is moving. As interest prices decline, fixed annuities may shed some appeal, while products such as fixed-index annuities and RILAs gain grip. If you're in the marketplace for an annuity in 2025, shop meticulously, compare choices from the very best annuity business and prioritize simpleness and transparency to find the right fit for you.

When selecting an annuity, economic strength ratings issue, however they don't inform the entire tale. Here's exactly how contrast based upon their rankings: A.M. Ideal: A+ Fitch: A+ Requirement & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A.M. Best: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A higher financial score or it only mirrors an insurance provider's monetary strength.

If you concentrate only on ratings, you could The ideal annuity isn't just about firm ratingsit's around. That's why contrasting actual annuity is more essential than just looking at economic strength scores.

We have years of experience helping individuals locate the ideal items for their demands. And since we're not associated with any type of firm, we can give you objective recommendations about which annuities or insurance coverage plans are best for you.

We'll assist you sort via all the options and make the very best decision for your situation. When picking the ideal annuity companies to advise to our customers, we use a thorough approach that, after that from there that includes the adhering to requirements:: AM Finest is a specific independent rating company that assesses insurance provider.

, there are lots of options out there. And with so lots of selections, knowing which is best for you can be hard. Go with a highly-rated company with a solid track record.

Point To Point Indexed Annuity

Pick an annuity that is simple to understand and has no tricks.

Nonetheless, some SPIAs use emergency situation liquidity features that we like. If you look for a prompt revenue annuity, take into consideration fixed index annuities with a guaranteed lifetime income cyclist and begin the earnings right away. Annuity owners will certainly have the versatility to turn the retirement earnings on or off, accessibility their cost savings, and be able to stay on top of inflation and earn rate of interest while obtaining the income forever.

There are a few essential aspects when searching for the best annuity. Contrast rate of interest rates. A greater rate of interest rate will certainly offer even more growth capacity for your financial investment.

This can promptly increase your financial investment, yet it is vital to understand the terms and problems attached to the incentive before spending. Think about whether you desire a lifetime income stream. This sort of annuity can give satisfaction in retirement, however it is necessary to ensure that the earnings stream will certainly be ample to cover your requirements.

These annuities pay a fixed month-to-month amount for as long as you live. And even if the annuity runs out of cash, the regular monthly repayments will certainly continue coming from the insurance coverage business. That means you can rest very easy knowing you'll always have a consistent income stream, no issue how much time you live.

Knights Of Columbus Annuity Rates

While there are several different sorts of annuities, the very best annuity for long-term treatment costs is one that will spend for many, otherwise all, of the expenditures. There are a couple of points to consider when choosing an annuity, such as the size of the agreement and the payout options.

When selecting a set index annuity, contrast the readily available items to find one that best matches your demands. Appreciate a life time revenue you and your spouse can not outlive, providing monetary security throughout retirement.

Bonds Vs Annuities

In addition, they enable up to 10% of your account worth to be withdrawn without a charge on the majority of their product offerings, which is higher than what most various other insurance provider allow. An additional consider our suggestion is that they will certainly permit senior citizens as much as and consisting of age 85, which is also more than what some various other business allow.

The best annuity for retirement will certainly depend on your private demands and goals. A suitable annuity will offer a consistent stream of earnings that you can depend on in retired life.

Annuity Secondary Market

They are and consistently use some of the highest payouts on their retirement income annuities. While prices vary throughout the year, Fidelity and Guarantee are normally near the leading and maintain their retired life earnings competitive with the other retirement income annuities in the market.

These rankings offer customers a concept of an insurance provider's monetary stability and exactly how likely it is to pay on insurance claims. Nevertheless, it is essential to note that these ratings do not necessarily show the quality of the items used by an insurer. An "A+"-rated insurance policy business can use items with little to no growth possibility or a lower revenue for life.

Your retirement cost savings are likely to be one of the most essential investments you will ever make. If the insurance firm can not achieve an A- or better ranking, you should not "wager" on its competence long-lasting. Do you desire to bet cash on them?

Table of Contents

Latest Posts

Annuity Rider Charge

Annuities Usaa

Northwestern Mutual Variable Annuity

More

Latest Posts

Annuity Rider Charge

Annuities Usaa

Northwestern Mutual Variable Annuity